Once you agenda an expenses fee, you’lso are authorizing their bank to credit the new biller that have money from your account. The fresh ACH system moves the bucks from your own membership and you will for the biller’s account. The professionals has five possibilities you could imagine if the mobile money wear’t look like a opportinity for you.

Cards

- Apple Shell out the most common mobile deposit actions, since it’s associated with your own mastercard, which’s very easy to explore.

- You can either collect the new cashier’s consider from the a performing Navy Government part otherwise get it mailed for your requirements.

- To possess concerns otherwise inquiries, please get in touch with Pursue customer support or let us know regarding the Pursue problems and viewpoints.

- After you have an authorized gambling enterprise membership, then you can choose to generate a cover from the cell phone casino put.

- Previously, only see financial institutions greeting users to deposit monitors off their new iphone 4, however, mobile financial is becoming even more preferred.

- Neither Wells Fargo nor Zelle now offers purchase security to have money made out of Zelle – for example, if you do not get the product your paid for or the object isn’t as discussed otherwise not surprisingly.

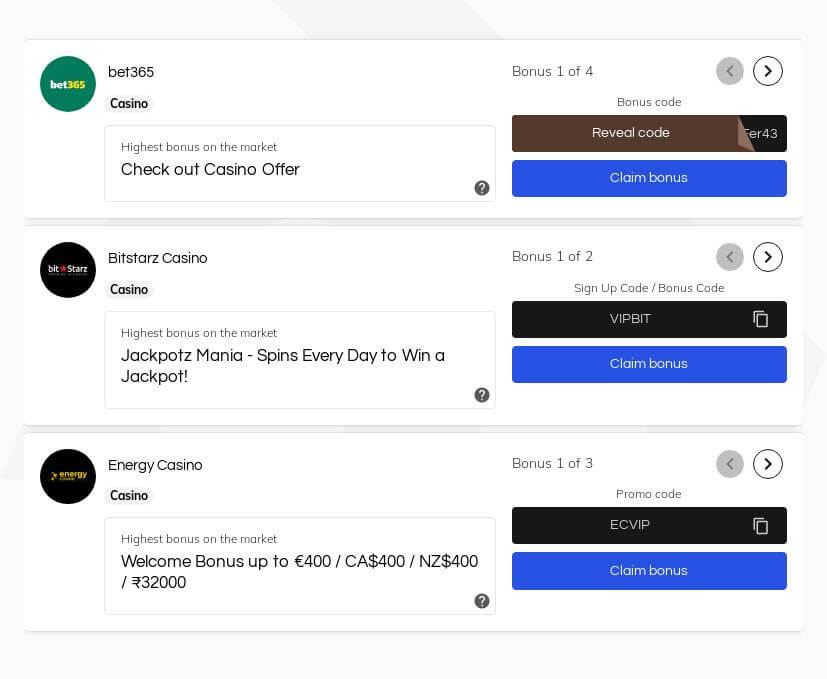

Be sure to know very well what these conditions are before you sign up in order to an on-line local casino or sportsbook. For individuals who’ve receive a gambling establishment that you’re happy with, the next step simply take is performing a merchant account. Simply click the new “Register” button and you can fill out the new models wanted to you to definitely manage your account. Money would be added immediately on the bankroll, you enjoy over control of your money and your local casino feel all the time. Use your online banking diary-in to pre-fill your application with saved suggestions. Gesa tends to make banking as basic, smoother and you can secure you could.

Remark and you may signal the look at

Chase isn’t responsible for (and you can does not offer) one points, characteristics https://vogueplay.com/in/igrosoft/ or posts at that third-people website otherwise app, with the exception of services and products one to explicitly bring the new Chase name. Cellular Put is actually a secure solution to deposit inspections on your smartphone in the Us. This informative guide will help you can fool around with cellular put and you can address faqs.

remittance alternatives

Since you ought to be the only 1 responsible for their mobile, simply you can publish and establish the fresh messages making the put. Because you provide no information to your online poker webpages at the side of their cell phone number, your finances otherwise mastercard information should never be at stake. Cellular consider put try a banking software ability one to lets you from another location put a check on the a checking or bank account.

Following that, you can financing your account and request one distributions to your Bitcoin bag. Available for Casual Players – The a lot more than has merge to make deposit because of the cellular telephone costs the best means for everyday players. Because the method comes with a minimal month-to-month restriction deposit restriction, it also helps for individuals who’re seeking to stick to a spending budget. Pay by the cell phone casinos allow you to deposit financing rapidly and you can effortlessly, without having to unlock any additional accounts.

Technology troubles, for example, makes it impossible to use your mobile take a look at put app if here’s a problem. And you will be unable to explore cellular consider put if your view you will want to put try above the restrict greeting by the bank. The fresh Pursue examining people enjoy a good $300 bonus once you open an excellent Pursue Overall Checking account making head deposits totaling $five-hundred or maybe more within 3 months away from voucher enrollment.

This means ACH money may need more hours in order to import between profile. However, as the February 2018, same-time ACH payments have become far more widely available. As well as in 2021, the fresh ACH network processed 604 million exact same-day ACH transfers.

After you submit the fresh deposit, the lender usually procedure and you will ensure they. This could take a couple of minutes to a few months, based on your own financial’s principles plus the quantity of the bucks buy. You are going to discovered a notice since the put is actually approved or refused. In case your put is rejected, attempt to followup to the lender to resolve the situation. Using by cellular phone bill try recommended if you have sufficient borrowing from the bank on your own prepaid SIM. You should use that when your mobile gambling establishment welcomes investing by the cellular.

When we come back an item to you unpaid-for any reason (including, as the payment are avoided otherwise there were lack of money to expend it) your concur never to redeposit one Item through the Services. Your invest in keep up with the Item within the a secure and you will safe ecosystem for example day from the time out of deposit acknowledgement (“Storage Period”). Up on request from Financial otherwise Merrill, you are going to promptly supply the Item to help you Lender or Merrill throughout the the fresh Retention Months. After the brand new Maintenance Period, you agree to damage the thing inside a safe style. Came back Points.You are exclusively responsible for anything in which you has become given provisional borrowing from the bank, and you can any such Goods which is returned or refused can be charged to your account. Your acknowledge that all loans gotten to have deposits made from Provider are provisional, susceptible to confirmation and you will final payment.

Consider all day long and cash you save by maybe not being required to look at the lender to help you deposit an income. And in case you employ ACH for online expenses money, you steer clear of the must pick seal of approval and envelopes. ACH performs an important part in the way consumers perform the funds every day.

Technical issues, such as, will make it impossible to make use of mobile cheque deposit software if here’s a problem. And you may not be able to have fun with mobile cheque put if your cheque you should deposit is over the restriction welcome from the financial. Current cards are good, particularly when you get her or him for free. However, both, all you need is cooler, income to expend the newest rent, posting a friend some cash, or get caught up for the specific debts. On this page, I’ll make suggestions tips convert the Charge current cards so you can cash. But not, this is a danger that accompanies any on line interest.

As possible make use of these option gambling establishment percentage choices for each other dumps and you can distributions, he has a significant advantage on deposits because of the cell phone and may also be just what you had been searching for. There are numerous alternative methods to help you withdraw your funds from spend by mobile phone casinos. Our very own necessary web sites give a variety of choice cash-out choices. Financial transfers would be the most common, but age-wallets, cryptocurrencies for example Bitcoin, and other tips are also available.

During the the assessment process, i found out you to one another actions accept the absolute minimum deposit from £5 and you will at least withdrawal of £10. Surprisingly, players take pleasure in open-ended deposit and withdrawal limits, making certain seamless transactions with no limitations. Simultaneously, the absence of a monthly cashout cap reveals the newest gambling establishment’s dedication to delivering players with unmatched self-reliance. Furthermore, winnings try canned within this 2-3 working days, that may appear excessive for those who appreciate prompt control.

To have enterprises, ACH costs make it reduced and easier to collect repayments of customers. There’s its not necessary for people so you can send a check or pay having profit people. And you can ACH costs are often inexpensive to own enterprises to help you procedure than the bank card money. Everyday, vast amounts of dollars flow gently through the You.S. financial system run on a complicated however, female fee program named the fresh Automatic Cleaning Home – ACH.