Posts

Because the a passionate endorse for financial wellness, I am seriously interested in discovering and you will revealing the top bonus product sales to maximise their earning and you may offers potential. Within my spare time, I’m a skilled tourist, usually performing itineraries to possess my next daring journey. Read on below to learn more factual statements about that it FanDuel promo code, along with conditions, requirements, and ways to claim they.

Such as cash-straight back or issues-dependent mastercard invited extra now offers, cards having introductory 0% Apr now offers could add plenty of well worth on the earliest-year investing. You may also see an excellent signal-up bonus and you can a powerful advertising and marketing Annual percentage rate give from the exact same credit card. This is basically the most frequent sort of indication-right up bonus, however, there are others, as well. Particular playing cards, for instance, have extended now offers lasting provided annually. You will get a great improved advantages rate to the first year once opening your bank account or a deal to fit your entire first-year income. Since the a first-seasons cardholder, don’t forget about to maximise the added property value an introductory 0% Apr when you yourself have a huge following pick otherwise existing debt.

- Pursue is offering people a $one hundred dollars added bonus when they unlock a new Pursue School Examining account and you will done ten being qualified deals within 60 days from discount registration.

- It’s vital that you have in mind why these type of bonuses are not constantly obtainable.

- Couple bettors might possibly be disappointed or let down that have FanDuel’s alternatives.

- A great signal-right up extra is amongst the most significant benefits away from opening a great the fresh mastercard.

- Costs, interest, payday loans, traveler’s checks, prepaid cards otherwise current cards, and other acquisition of cash alternatives cannot.

- We’lso are on holidays so you never have to “hold back until Saturday” to speak with our company.Subscribe today and now have become on the bonzer trip you can expect in the Grande Las vegas Australia.

14TD Past Examining membership are eligible to have Month-to-month Fix Fee waivers to the all the individual deals account of your choice to help you relationship to their TD Past Checking account. Pursue has to offer sixty,100 bonus what to the brand new Pursue Sapphire Set aside cardholders. Those issues is going to be used to own $600 dollars, otherwise they may be expanded in order to $900 for individuals who put them on the travelling because of Pursue Traveling℠. The fresh credit does not have any annual fee, and cardholders as well as enjoy feel such as VIP tickets and you may 5-superstar dishes, among most other advantages. Create accounts, pay the bills, publish currency to family members having Zelle and deposit inspections away from nearly everywhere.

Preferred Cash Perks Charge Signature Bank card

The fresh IHG You to definitely Perks https://casinolead.ca/minimum-deposit-casinos-canada/ Prominent Mastercard will bring automatic IHG Rare metal status and you may perks high rollers. You can make Diamond Elite status just after investing $40,100 to your credit within the a twelve months. In the act to earn Diamond condition, you can generate an excellent $a hundred declaration credit and you may 10,100 IHG things after using $20,one hundred thousand in your credit in the a twelve months. Every year you will discovered a totally free evening honor that’s legitimate during the IHG rooms charging 40,100 things or smaller. The main city You to definitely Venture Benefits Bank card provides a fair yearly percentage and you can brings in versatile take a trip benefits, which makes it an excellent travel card for beginners or heavier traffic. The capital You to Quicksilver Dollars Rewards Credit card has no annual fee, cash-right back benefits and a generous intro-Annual percentage rate give, which make it a great option for rescuing on the interest when you’re earning rewards.

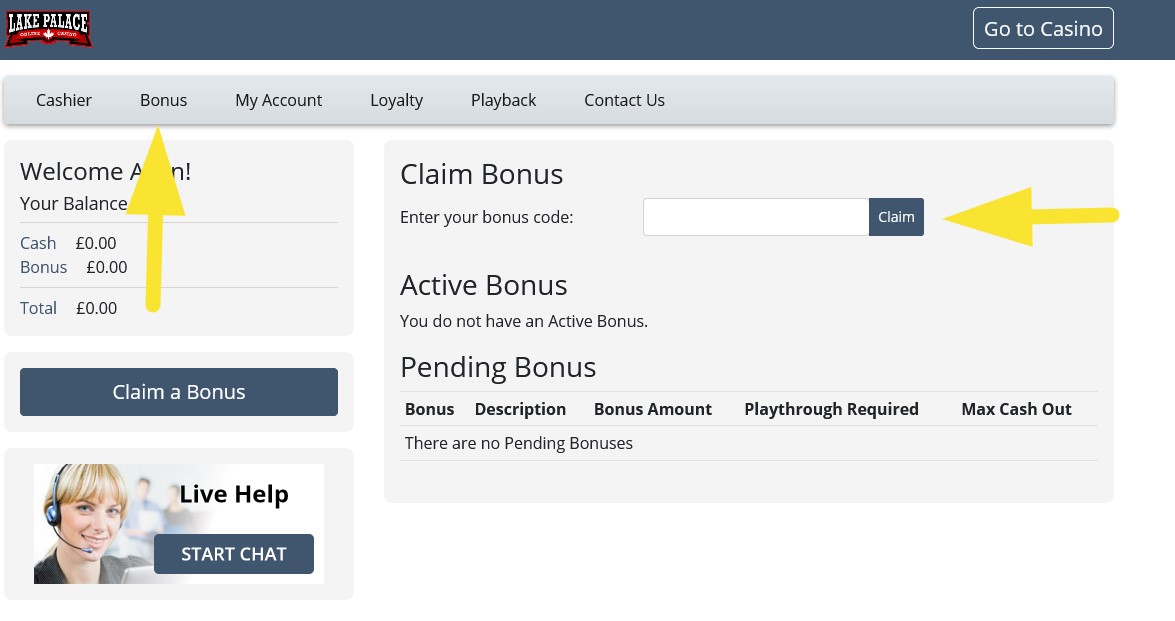

If you are applying on line, Unincorporated Company Connectivity or Organizations commonly offered on the web at this time. When you are using online, partnerships aren’t served on the internet at this time. Not merely create they supply access immediately in order to personal bonuses and you will advantages, nevertheless they may rather increase playing sense. People usually get tips for you to redeem such coupons however it could be over while in the subscription or when claiming the new added bonus. As well as becoming one of the most much easier networks to possess saying a no-deposit bonus, Castle Away from Possibility also offers an abundant join incentive to possess the newly inserted people.

Render Automatic teller machine credit?

Discover Family savings Agenda an enthusiastic AppointmentOpen a super Prize Examining, Merely Totally free Checking, Provident Examining, or Digital Edge account and you can discover a great $300 incentive! Amex provides either shown a much bigger, focused render for some people as a result of particular channels. For many who’re also searching for searching for a far greater offer about this card, discover our publicity of the finest Bluish Dollars Well-known acceptance offers. The newest Blue Bucks Preferred Cards away from American Share offers the best money back rewards at the You.S. supermarkets, and an excellent room of consumer insurance rates benefits. When you’lso are ready to receive their points, you can receive sixty,100000 points for money-straight back at a rate of just one penny per suggest rating $600 in the well worth.

Better Handmade cards

Greeting incentives along with normally have spending criteria that have to be fulfilled within this a particular timeframe and they requirements commonly an easy task to satisfy. The capital You to Strategy Perks Mastercard is for those who require luxury benefits without paying the fresh highest yearly fee away from a great premium bank card. The brand new Pursue Independence Endless is a no-annual-percentage card one brings in nice bucks-back to your informal sales and you can a profitable greeting extra. The administrative centre One to Savor Cash Perks Charge card is the most more rewarding options for earning cash back to kinds for example because the entertainment and you can eating without paying an annual payment.

TD Lender Beyond Examining $300 Extra

A sign-upwards added bonus is a publicity provided by a charge card issuer so you can entice you to make an application for a card and commence playing with they continuously. The phrase “sign-up incentive” is a little out of a misnomer because the more often than not you do not get the main benefit for only registering; you have got to secure it because of the extra cash. That’s why some issuers explore terminology such as “extra give,” “acceptance render” or “the fresh cardholder give” rather than signal-up incentive. Which tax treatment solutions are a supplementary reason mastercard bonuses should be earned thanks to using, and why the desired investing matter is larger than the advantage by itself. For many who invest $step one,000 and have an advantage out of $150 to possess performing this, that you do not “emerge to come” — you’ve nonetheless produced $850 in the net orders.

Frequently asked questions from the financial advertisements and you can indication-up incentives

Put differently, you can’t earn a sign-upwards incentive because of the “to find money” and then paying down your balance with that money. When you hit the necessary using matter, you’ll get the added bonus. With many bucks-back cards, the bonus you’ll immediately appear because the a card up against orders to the the monthly declaration. Most of the time, even if, the main benefit appears on the benefits harmony, alongside the things, miles otherwise cash return you have made from the spending.

When you complete the needed investing, the bonus is put on your bank account. That have an everyday indication-up incentive, enough time frame for earning the advantage can be about three to help you six months. The greater amount of rewarding the bonus, the greater amount of you can will often have to invest during that time in the purchase to make they. For example, a cash return credit you’ll render an advantage away from $150 to $200; to make it, you may need to spend $five-hundred otherwise $1,100. A trips otherwise journey mastercard you will provide points or kilometers worth $750 or even $step 1,000 however, will demand spending away from $step 3,one hundred thousand or even more.

The new Pursue Sapphire Well-known Card bags a slap to own a $95 annual percentage card, giving yearly traveling loans, comprehensive traveling defenses and much more. Constantly, you receive the newest welcome extra give to suit your the brand new card in the the brand new statement once you meet up with the minimal spending requirements, the amount of cash you ought to spend on the new credit to find the welcome added bonus render. It always have to be completed within the very first ninety days out of beginning the fresh credit.

The brand new Blue Cash Preferred even offers casual perks groups that make it perfect for enough time-identity well worth — for as long as the new perks you get yearly is sufficient to block out the brand new constant yearly fee. Evaluate the typical investing to the potential annual cash return rewards to make sure you’ll earn significantly more yearly compared to the cost of which card. Certainly one of all of the bucks-right back playing cards we compared, the newest Blue Bucks Common’s welcome render topped the list for added bonus bucks worth. You’ll have a complete 6 months to fulfill the newest $3,100000 spending needs (equal to on the $five-hundred per month). In contrast, of numerous invited bonuses out of dollars-straight back notes best out as much as $two hundred. When you want to apply (and are recognized) to own an alternative charge card as a result of the site, we might receive payment from your couples, which could possibly get impression exactly how otherwise in which these products come.

Of course, there are plenty of a method to optimize the bonus items made from the welcome added bonus, but understanding how to get the most from your $3 hundred Pursue Take a trip borrowing from the bank is out of equal strengths at this time. Having an excellent $three hundred Pursue Traveling borrowing from the bank at your disposal is an excellent tool to save cash on the typically pricey hotel stays without the need for issues. Even although you run into a journey you to definitely is higher than the fresh $300 draw, this can be a good unit to attenuate your out-of-pocket costs.

As a result, in the no additional prices to you personally, we would get paid once you click on a connection. We’re going to posting the main points right to your email, as well as a reminder when the provide is just about to expire. Banks extremely will give you free money for starting an membership. The brand new “best” give for new cardholders try a moving target for a couple of grounds.